Web3 Insurance: Complexities and Innovative Opportunities

A new era of the internet is here with Web3 technology, and it brings something that traditional insurance hasn’t seen in years: the possibility of disruptive innovation.

Web3 can also be seen as a natural response to Big Tech that materialized from Web 2.0. Social media and other user interface interactions were an incredible new Web 2.0 technology, but these platforms also meant that the tech giants owned and, unfortunately, abused personal data. Web3 technology, on the other hand, provides transparency (all transactions are visible to everyone on the network through a publicly accessible blockchain), decentralization (no one party can own or control a blockchain), and ownership of one’s own online data.

Through Web3 blockchain technology, a number of opportunities seem to be emerging for insurance companies, including the possibility of some incredible innovations. As expected, though, with Web3 still in a nascent stage, there’s also quite a bit of complexity for insurers.

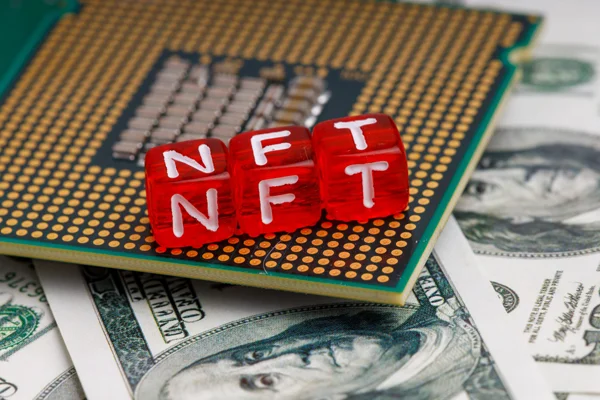

Much of Web3 tech still feels intimidating to most consumers; cryptocurrency and NFTs are a completely new type of economy. In addition, the cryptocurrency market is still quite volatile, as can be seen in the most recent “crypto winter,” and assets such as NFTs are often misunderstood. With all of the instability surrounding the Web3 economy, insurance companies are hesitant to get involved, let alone know exactly how to get involved.

The Complexities

It’s understandable that insurance companies are not leaping into the fray of insuring Web3 assets just yet. The complexities need to be addressed in order for insurers to successfully find stability within the market.

Risk Assessment

One of the most glaring problems involves how to assess risk in such an unstable market. It’s simply not possible to offer the same traditional insurance policies as on, say, stocks or bonds that come with protective regulations. Fortunately, the introduction of the Responsible Financial Innovation Act bill into Congress, if passed, could bring some needed stability to the crypto market. In fact, many venture capitalists are showing more interest in crypto infrastructure and Web3 companies with the emergence of regulations.

Underwriting

First, while there are some obvious risks in Web3 (such as theft) that insurance companies can prudently underwrite, there’s a lack of precedence available, making insurance in the Web3 economy completely new territory. Because of this, insurers will have to be extremely clear on what risks are covered in the policy and communicate this coverage effectively to customers.

Scalability

The scalability, or lack thereof, is a critical problem that insurance companies must solve in order to be successful in offering Web3 insurance. As mentioned above, cryptos, NFTs, DAOs are all completely new tech that intimidates the average consumer. While this slow adaptation offers opportunities, it also can provide scalability problems for insurers.

Distribution

Finally, distribution provides a couple of problems for insurers to solve. How will consumers find the type of insurance they need and then how will they pay for claims? Insurance companies also need to keep in mind that Web3 offers opportunities for insurance beyond the traditional models, but this also means that insurance companies need to communicate value clearly to their customers.

Innovative Opportunities

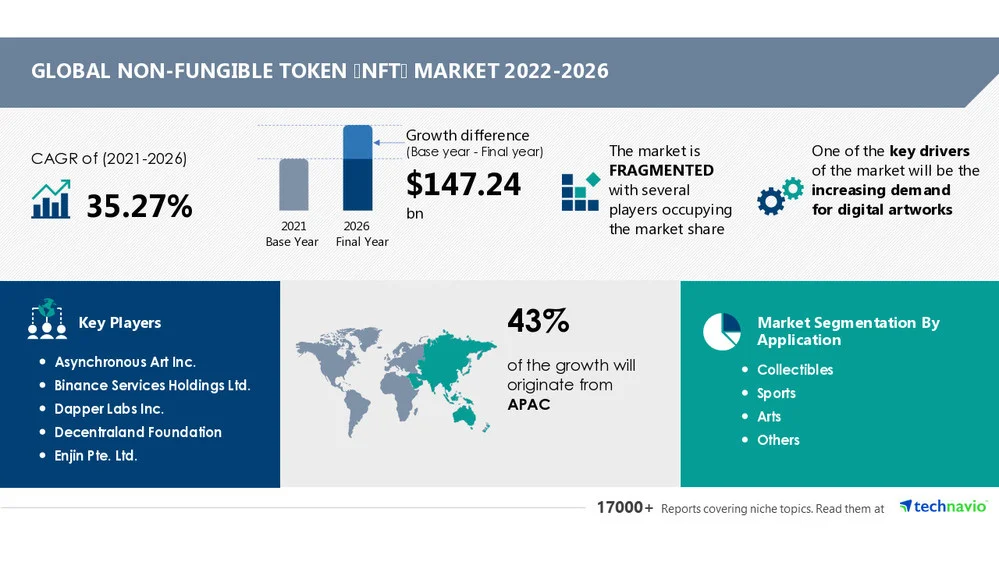

Despite the complexities, the Web3 economy allows for innovative opportunities that insurers have not had in years. After all, Bitcoin, Ethereum, and thousands of other cryptos have made news as more than $1 trillion dollars have flowed into these assets. There are 300 million global owners of cryptocurrency today, and the price of Bitcoin increased by over 540,000% from 2012 to 2022. The Non-Fungible Token (NFT) Market Research Report by Technavio predicts that between the years of 2022 and 2026, NFTs will see an incremental growth of $147.24:

Yet with all of this growth, it is estimated that less than 1% of these crypto assets are insured. It’s not for lack of demand, either. Timothy Fletcher of Aon PLC says that there are plenty of customers who want coverage, but that there’s a “mismatch between demand and supply.”

This high demand could mean a huge opportunity for insurance companies. So far, the few companies that have started underwriting for Web3 are only doing so for individual crypto investors (in the form of crime and custody policies) or for crypto businesses.

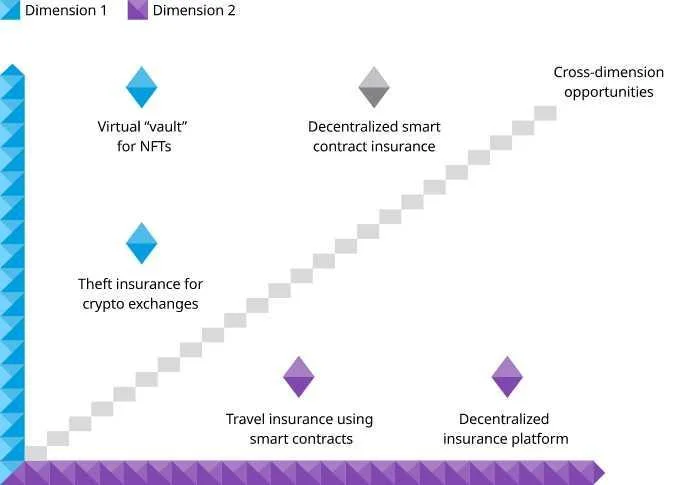

The most recent edition from the Oliver Wyman Reinventing Insurance series provides some excellent guidance in understanding just how rich the opportunities are for insurance companies within the Web3 economy. According to the Wyman report, there are two “dimensions” or areas that insurance could potentially jump into Web3, broken down in the following graph:

Not all of these examples necessarily go beyond traditional insurance.

Crypto Theft Insurance

Some insurance companies are already offering theft insurance policies on larger cryptocurrency exchanges for both the corporation and the buyer, but this is just a rewrite of traditional theft insurance. However, a more innovative policy could also include coverage in the case of a lost cold-storage key.

NFTs

Non-fungible Tokens (NFTs) are a good example of assets that could be insured as well. However, it’s important to understand that NFTs are basically a digital “receipt” (blockchain tech) that proves ownership. For example, a consumer could purchase an NFT to show ownership of a piece of digital art that they can display on their website. In this case, insurance could underwrite against theft of this NFT or even offer some type of decentralized type of title policy.

Smart Contracts

Insurance could cover either assets or liabilities as decentralized smart contract insurance, and the big innovation in this area involves the processing speed of claims. With smart contracts, insurance can use third-party data to evaluate claims in real-time, and because it’s all automated, there’s no need to wait on insurers to process the claim. Smart contracts are also transparent, meaning that all parties involved can see the terms of the contract and the execution history.

DAO’s

Another consideration is that the insurance industry is seeing a large influx of insurers seeking to enter the decentralized autonomous organization (DAO) space. These organizations are built on the premise of automation and trustless cooperation, which can provide a number of benefits for both policy holders and insurers. For policyholders, DAOs can offer lower premiums, more transparency, and a greater say in how their money is spent. Insurers also benefit from DAOs, as they can reduce costs and improve efficiency.

Thinking Outside the Box

Web3 capabilities mean new innovations in customer-focused value propositions, and new business models are possible as well. For example, token policies are possible with blockchain-native insurance, which would allow for policies to be sold or traded if a user no longer needs them. Also as the Oliver Wyman report points out, an insurer could create a decentralized platform similar to the app store in which anyone could offer an insurance product, making bundling and customizing much more user-friendly.

Most insurance companies are not going to be able to create innovative policies without some help, though. As mentioned before, Web3 comes with quite a few complexities. Having someone who not only understands Web3 technology but also has an innovative mindset will help insurers go beyond traditional insurance and step into a brand-new world of policies.