Human in the Loop and AI: Organic Intelligence meets Artificial Intelligence

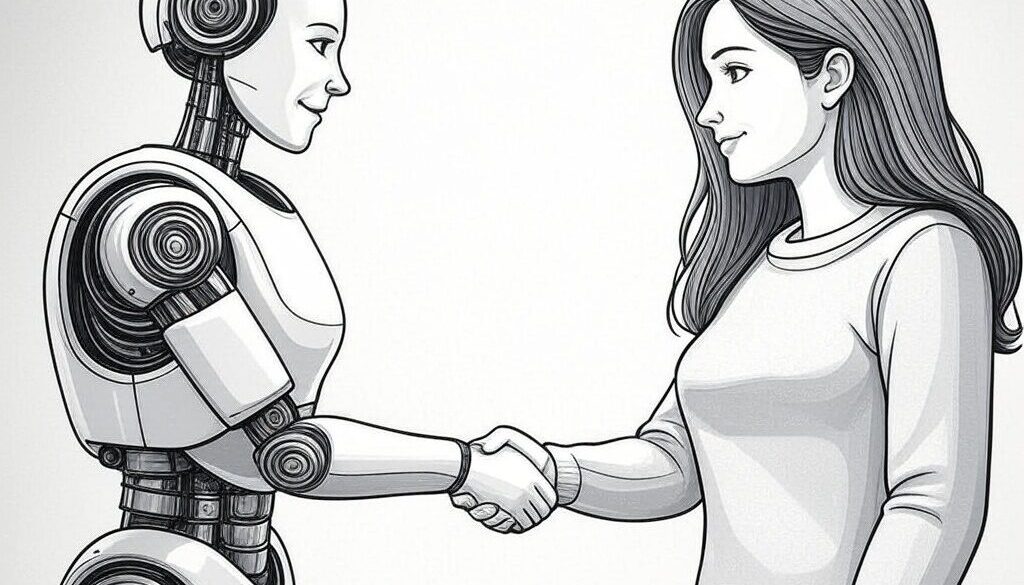

We are not living in a simulation. AI is here to stay. The life insurance industry has always balanced technological innovation with human expertise. Today, as artificial intelligence transforms the playing field, “Human in the Loop” (HITL) systems offer the ideal middle ground—combining AI’s efficiency with the irreplaceable judgment of experienced insurance professionals. Rather than replacing underwriters, agents, and compliance officers, these systems have the potential to enhance their capabilities, allowing your team to focus on what they do best while AI handles repetitive tasks.

What Is “Human in the Loop” and Why It Matters for Life Insurance

Human in the Loop refers to AI systems that incorporate human judgment at strategic points in automated processes. In practice, this means AI handles data processing and initial analysis, but human professionals review, approve, or adjust the output before final decisions are made.

In an industry where trust is paramount and regulatory requirements are stringent, HITL offers the perfect balance: the speed and consistency of automation with the wisdom and accountability of human oversight.

The 2 AI Dilemmas: Empathy and Accuracy

I think what I have noticed in the past year of navigating various AI systems, models, and applications there are really 2 dilemmas that must be solved when building AI products. Empathy and Accuracy.

Empathy isn’t Underrated

The truth is, AI can not be truly empathic. It can mimic empathy, but obviously lacks that ‘spark’ us humans all have to interpret nuanced interactions with one another. Even when looking at a client’s policy, our ability to both imagine their circumstances and understand what they are going through, on a personal level, impacts and improves our ability to serve them in positive ways. It helps us ‘see outside the box’ on their behalf.

AI doesn’t possess empathy. And while our conversations with Large Language Models are certainly engaging, it is really ‘us’ who are creating the engagement. This is where Human in the Loop can make a difference. By inserting an organic mind and human spirit into the AI process, we are able to leverage the analytical power of technology against the deeper, nuanced understanding we are all born with. We can, in essence, infuse empathy into the process.

Accuracy is Everything

Humans have grown accustomed to machines being highly accurate. Whether we are using an abacus or macbook pro, for eons we have been able to reliably depend on the accuracy of our machines. AI introduced a slightly different moment in that regard. AI can hallucinate. AI can make things up in its desire to answer our questions. While this aspect makes it intrinsically more human-like (my father used to always make up fantastic answers to questions he didn’t know the answer to 🙂 ) it also introduces a problem.

Life insurance requires accuracy.

This is why we have specialists at each step along the policy path. If you think about it, humans put other humans ‘in the loop’ all the time.

Advisors explain life insurance products to clients. The application is processed by people at the BGA. The BGA relies on underwriters to determine eligibility. And so on. Each step is monitored by different people. This is by design. It helps create a more nuanced and accurate flow.

Since AI can make mistakes, it is important for another entity to review its process before making anything official. Human in the Loop allows for this relationship between people and machines without sacrificing the creative nature of the AI technology.

Analog vs Digital from an Emotional Perspective

According to a study by the United States Postal Service and Temple University’s Center for Neural Decision Making, physical mail drives stronger emotional responses than digital media. The study showed that tactile materials required 21% less cognitive effort to process while leaving a longer-lasting impression.

This is pretty interesting and I think it applies to the world we are in today. While AI can help us create a sense of humanity with it, ultimately its communication with clients comes from a digital voice. In a world where everything is digital, Human in the Loop can become the ‘handwriting’ that keeps us truly connected to the consumer – improving relationships and outcomes overall. This will be critical as AI continues to shine in future use-cases for our industry.

Future Directions: The Evolving Role of HITL in Life Insurance

As AI capabilities advance, HITL systems will continue to evolve:

Predictive Needs Analysis: Future HITL systems may proactively identify changing client needs based on life events and demographic data, with advisors reviewing these insights before reaching out to clients with personalized recommendations.

Dynamic Underwriting: More sophisticated AI could enable truly dynamic underwriting, where policy terms adjust based on changing risk factors, with underwriters overseeing these adjustments rather than processing routine renewals.

Integrated Compliance Monitoring: Rather than point-in-time compliance checks, AI could continuously monitor for regulatory changes and flag policies or practices that may need updating, with compliance teams focusing on implementation strategy.

Enhanced Fraud Detection: Advanced AI could identify increasingly subtle patterns of potential fraud, directing investigators to cases most likely to be problematic rather than requiring broad manual reviews.

Embracing the Human+AI Future of Life Insurance

The life insurance industry has always been built on balancing precise risk assessment with human judgment and care. Human in the Loop AI systems represent the natural evolution of this approach—enhancing rather than replacing the professionals who make our industry work.

By implementing thoughtful HITL systems, carriers, agencies, and advisors can achieve the seemingly contradictory goals of greater efficiency and higher quality. Processing times shrink while compliance improves. Client service becomes more responsive while maintaining the personal touch that builds lasting relationships.

Our industry deals directly with life and death, with the unknown future. In many ways, life insurance is a deeply emotional product. The future of life insurance isn’t about choosing between human expertise and artificial intelligence—it’s about creating thoughtful partnerships between the two. When implemented with care and strategic vision, HITL systems allow us to preserve the human judgment and relationships that define our industry while embracing the efficiency and consistency that technology provides.

For life insurance professionals, HITL represents not just a technological shift but an opportunity to refocus on the aspects of our work that create the most value: building relationships, providing insightful advice, and ensuring financial security for families and businesses. By embracing this approach, we can make our industry more efficient, more compliant, and ultimately more effective at fulfilling our core mission.